This interview with Christie's evening sale head Sara Friedlander is part of our cover feature "Auctions vs. Art Fairs: Behind the Battle for Your $$$," in which Friedlander and new Armory Show director Ben Genocchio explain the virtues of their particular art-market models.

You’re the head of the evening sale at the number-one auction house in the world, catering to the top buyers anywhere with works estimated in the millions. At the same time, Christie’s also has the First Open sale, where works by major names and newcomers are available in the low five to middle six digits, and you also have the day sales, where works can be found at prices that are competitive to the primary market. What would you say is the typical profile of a buyer who comes to a Christie’s sale, as opposed to an art fair like the Armory Show?

They’re the same client. The people who bid and buy in art sales are the same clients who are going to fairs, for the most part. It’s interesting to break down the differences between the fairs and the auctions, and how people shop and buy, but as somebody who’s been on both sides, I see the art world as an ecosystem—it’s a community of people who are buying and selling and looking at and exploring art. Maybe they do it for different reasons, but they’re mostly savvy enough to be able to access all different levels of buying and all different platforms in which to do so. So, I wouldn’t say that there’s a distinction between the people who go to an art fair and who go to an auction house, except to say that maybe there are better culinary options offered at a fair.

Ok, so say you’re a buyer and you have a budget allocated for buying art that year. Obviously, art fairs and auctions represent two very different modes of collecting—they offer different kinds of excitement, they have different sociability factors involved, and the type of art is often different. How would you lay out those distinctions?

The most important thing to emphasize is the difference between the primary and the secondary market. As you know, the primary market is where the galleries are showing the work of an artist directly, cultivating that artist’s career, and thinking strategically about where their works are heading, whether to foundations or institutions or private collectors. I cannot stress how important this market is for the ecosystem of the art world—we need galleries to protect and take care of artists.

Now, I have never met anyone who works at an auction house who didn’t care about artists. We all do—that’s why we're in this business. But it’s not our job, necessarily, to promote and develop a career of a young artist.

So, at an art fair—especially a fair like the Armory—you’re going to see a lot of primary-market work. Sometimes that’s a solo exhibition by a new artist that a younger gallery might be debuting, or sometimes an artist will make work specifically to help with the inventory for that fair. The biggest difference is that the auctions are all secondary-market works, which means that they are not coming to sale directly from artists and their galleries but rather through other sellers who have previously owned the work.

One risk with the primary market is that, because the art is still more or less fresh, you really need to rely on your eye or the advice that you’re getting when deciding whether to buy. If you go to an auction house, on the other hand, there’s generally more of a patina of history attached to the works, where you can see how a piece fits into the arc of an artist’s career.

I agree, and what you’re saying really underscores the unfortunate risk of a market overtaking the progression of an artist’s work, which we see happens all the time. At a fundamental level, a collector should buy what they love so if these kinds of market-balloon bursts occur, they remain with work that inspires them and that they’re very happy to live with on their wall. I think that to foresee these instances, a collector should also look at the big picture, and that’s where the gallery and the primary market really comes into play. So, is the artist receiving curatorial and institutional attention? Are they being reviewed by critics? Have we visited their studio? Do we believe in what they’re doing, and what they’re going to do next? I think the answers to these questions will help a collector figure out how they should look at an artwork, and how it should be viewed in in terms of investment.

Currently, analysts of the art market are predicting that volatility in the wider financial arena won’t make too much of a dent in the top of the market, but that it will likely constrict sales at the lower rungs. Considering that an auction house like Christie’s is famous chiefly for its record-breaking evening sales, what is an auction’s appeal to lower-end buyers, as opposed to the fattest of cats?

I would respond by saying that last season, in the same week that we sold Modigliani’s Nu couché for $170 million dollars, we also had our highest day-sale totals to date. What that really speaks to is a continued strength in the core area of the art market, and by “core” I mean roughly a quarter of a million dollars to $1.5 million. So Christie’s continues to offer buyers a broad choice from a wide range of price points, categories, artists, and different periods in a very transparent type of marketplace, as well as unique curated sales and access to works from amazing private collections like that of Arthur and Anita Kahn, with all their Calders.

Also, just to give you a stat, the number of new buyers of lots between even a lower price point like $10,000 and $150,000 grows every season, so that’s another really interesting thing to look at. Now, if you had $10,000, would it make sense for you to buy something at Christie’s? I think that you have to look everything. You should go to the Armory, go to the ADAA, and see what new artists have to offer that’s interesting for $10,000, maybe at a smaller gallery on the Lower East Side or in Berlin.

But, then, maybe you also open a Christie’s catalogue and you see a small very early Calder sketch for $10,000 to $15,000, or maybe you find a Will Ryman sculpture on our e-commerce platform for that price. And, you know, the estimates at auction are often going to be below what the retail is because we have to figure in a buyer’s premium, and also because we want to generate the kind of depth of bidding that we get against a low estimate. So that’s another way of saying you have to look everywhere.

In that case, how would you describe the competition between fairs and auctions?

When we talk about this question we really have to talk about the client, which in our case is as often the seller as it is the buyer. What is the best thing for the client, and what strategy will best serve them? A lot of times, that’s going to be buying at auction, because it’s transparent: there’s a sale date, it happens a room in real time, and there’s a willing buyer and a willing seller.

Sometimes that’s not the best strategy for a client—sometimes they want to sell something privately and do it very quietly. Of course, Christie’s offers an amazing private sales department, where all of us who are working on auctions are also working on private sales for people who don’t want the publicity of auction for a variety of reasons.

The art-fair model is interesting, because it’s sort of private in that the price isn’t necessarily released, but it’s public because everyone can see the art. Also, despite appearances, it’s not a real-time market, like an auction. Dealers at fairs try to presell their work, sending a list to their pool of collectors in advance and then waiting to see who offers. It’s not the immediacy of auction in the same way.

The auction houses use guarantees, though, prearranging a fixed bid at which a client will automatically buy a work. If the guarantee is high enough, most bidders would never have a chance, despite this illusion of a level playing field.

All guarantees are listed in the catalogue, or they’re announced before the sale. We are legally required to be transparent about these things.

As you mentioned, fairs don’t have the same obligation for transparency, and even if they look like marketplaces your lay collector might not be allowed to buy a work on view, or even find out its price.

Yes, nobody really releases a price list to the general public. Of course, if you’re a client of the gallery and you’re in their circle, you can get a price list. I don’t think they have to tell you, though, and they often don’t disclose how much something sold for afterward.

One fear that people have about buying at fairs is that you may be able to afford an artwork but, unlike at an auction, be turned away because the dealer doesn’t think you’re good enough. On top of that, due to the lack of transparency around prices, there’s a worry that the price one collector is quoted for a work may be different from the price another gets. How does that jive with your experience?

I found that was not true in my gallery experience but, look, I don’t know. But I can say this: even when there are guarantees in an auction scenario and the work sells to the guarantor, there’s still a very clear and public record of the piece selling or not selling. A lot of clients who I work with in this very unregulated art market are more comfortable with that way of buying and selling.

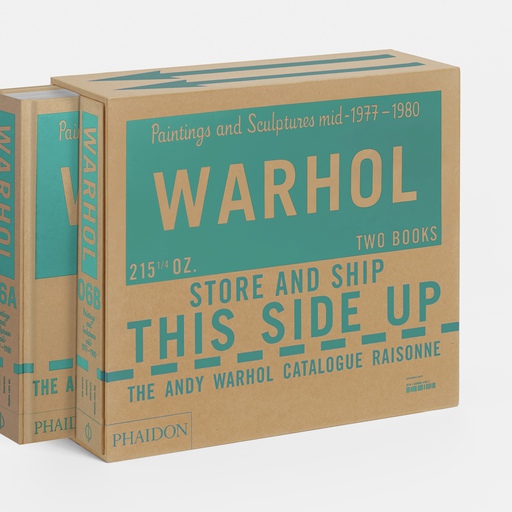

One way that auction houses have tried to open their sales up to a broader audience of buyers is with introductory-priced sales, like Christie’s First Open, which will take place on March 4. You worked for several years as the head of the First Open sale. Can you tell me what the thinking is behind that auction?

When we started First Open, it was really more about the sellers than it was about the buyers. It was about Mrs. X needing to sell 25 things that are all under $50,000—how do we deal with that without putting it in a sale with plates and furniture? But then it became this destination for newer collectors, and younger collectors, to buy at a lower price point. And, by the way, it’s no secret that we timed this with the Armory Show, because everybody’s in town. It’s a nice way of having people go to the West Side Highway for the fair, then come to Christie’s, and then maybe to the Whitney. It’s a way to activate New York as a place to see and interact with contemporary art.

As a lower-priced sale, First Open often includes work by younger artists, which has become a much-speculated-upon area of the art market. Flippers have been known to buy this kind of work in bulk, watch the market winds, and then offload them at auction when the conditions are right—not caring if the value of the artist’s work plummets as a result. How can someone who is just starting out avoid getting flipped to in one of these sales, only to a month later find themselves with a work worth half what they paid for it?

Christie’s is not really in the business of selling the primary market, and we generally don’t include work in our contemporary sales by artists who have never been to market before. But if a client wants to sell a work by an artist who’s never been at auction, we make sure to do our homework to get a hard grip on what their primary market is.

So, who is the artist? Who is showing the artist? Are his collectors in America? Are they international? Can you get his works if you wanted to or is there a waitlist? Is it the right work to inaugurate the artist’s market at auction? And, do we know—even if we don’t have a guarantee—that there are going to at least four to five people who will be bidding on it?

BESbswyBESbswyBESbswyBESbswyBESbswyBESbswyBESbswyBESbswyBESbswyBESbswyBESbswyBESbswyBESbswyBESbswyBESbswyBESbswy

Most importantly, is it priced correctly? Does the estimate reflect an in line expectation of what they were selling for privately? Ideally, you would want to get that right so that there’s enough depth of bidding—but of course, if something is retailing for $100,000, you don’t want to price it at $10,000. So, when we do this, and we don’t do this often, we have to make sure it’s selling and selling well.