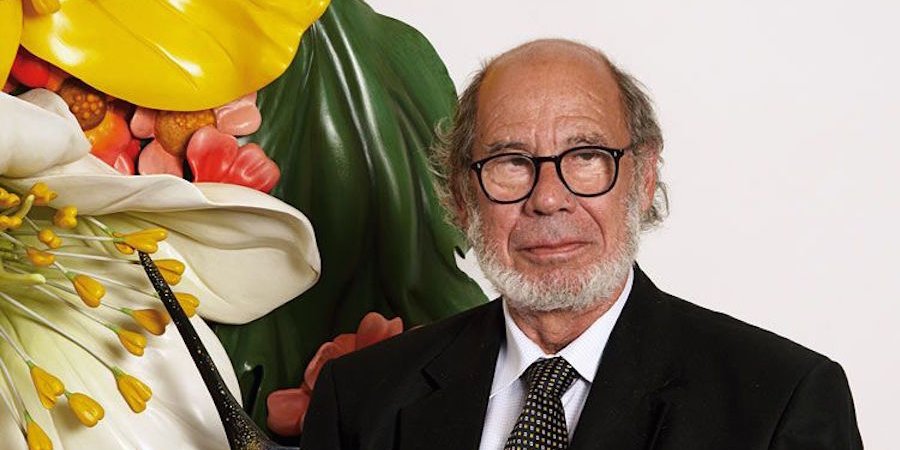

Ensconced within a stately townhouse on New York’s Upper East Side, the art dealer Robert Mnuchin has spent the past quarter century putting on shows of mostly American art that brim with intelligence, historical savvy, and the kind of quality that one tends to find a few blocks to the west, at the Metropolitan Museum of Art. At 82 years old, Mnuchin works out of an office on the building’s third floor, where he sits at a large desk covered by well-thumbed auction catalogues next to a phone that he’s liable to pick up on the first ring to say, as on a recent Wednesday afternoon, “I’m happy to say the de Kooning is yours!” The Morris Louis painting with the wingspan of condor lets you know he means business.

For years one half of the celebrated dealer team L&M alongside Dominique Lévy, who left in 2013 to start her own gallery in the same neighborhood, Mnuchin comes to his connoisseurship from an unusual place: Wall Street, where he spent 33 years as a weather-making trader at Goldman Sachs, earning the nickname “Coach” for his driving leadership of the block-trading department he founded. Today, with his new gallery partner Sukanya Rajaratnam, he continues to mount extraordinary shows—most recently, of the Ghanaian sculptor El Anatsui and the Gutai painter Kazuo Shiraga.

To become better acquainted with the philosophy guiding the gallery, Artspace editor-in-chief Andrew M. Goldstein spoke to Mnuchin about the unusually charmed arc of his career.

Whenever I come into your gallery, with its beautifully spare rooms and elegant finishings, I immediately remember two previous shows here that strike me as among the most powerful paintings shows I’ve experienced, the early Frank Stella show from 2012 and the David Hammons show from 2011. The Hammons show featured room after room of exquisite abstract paintings that had been covered by drop cloths, garbage bags, and other loosely draped textiles so as to all but obscure the paintings themselves. It was radical work, the kind of thing you would be delighted to encounter in an adventurous emerging gallery—not something you would expect to see in a decorous townhouse on the Upper East Side. What was it like working with Hammons?

He’s very much his own man, and this work reflects that. Who else would have thought of doing such a thing—who else has that originality and creativity? It’s something of importance—we’re not talking about Michelangelo, but it’s of real importance. And the reception was very strong. It was a very, very successful show. The buyers were more institutional than public. We recently were in his studio and saw another one that we thought was particularly strong, even given this rigorous body of work. It’s hard to find the adjectives to describe why something just hits you, but this really hit us.

On the other hand, the prices will really hit you too. The escalation has been enormous. I can tell you that I’ve had museums talk to me and ask if we could be of some help because they perceive us as being close to him. It’s a nice compliment, but we’re not close to him. He doesn’t allow people—or at least he doesn’t allow us—to be close to him. We’ve told them, “If you want to do an important show or a retrospective or whatever you want to call it, good luck!” I know that a number of major museums have actively approached him, and I think he’s just not interested. He wants to stay somewhat mysterious.

The story of your gallery is an extraordinary one, not only because of the quality of your shows but also because of how you came to be a dealer. In fact, before you opened the gallery, you had a wildly successful career in a very different field, as a storied trader on Wall Street for Goldman Sachs. Then, suddenly, you made a change.

I’m very lucky that I did, because I enjoy so very much what I do. I really do.

How long were you on Wall Street?

A little over 30 years. I started as a trainee in 1957 and left at the end of 1990, purely by choice. I wasn’t pushed—it was because I’d done the same thing for a long time, and I had an interest in seeing if I could achieve something in some other field. But it wasn’t so clear that I was going to open an art gallery at first.

How did you first become interested in art?

I’ve been interested in art for a long, long, long time, first as a museum-goer, then as a smaller collector, then as a little bit bigger collector. My wife and I did a lot of this together, the reading and going to museums and thinking about art. So, yes, we collect art, and, yes, we have a few wonderful things, but “collector” is a little too broad for who we are. We never made a major mark.

Where did you start out as a collector? You were on Wall Street during the period when everybody who wanted to show off was buying Impressionist paintings—those were the bling artworks of the era. Yet you began collecting postwar art.

First of all, we could hardly afford art. That has a certain amount to do with it. The first thing we bought was a Picasso print for $175, and that was a serious purchase! Financially, it was unthinkable to to go after the artists who were then the “modern masters,” the Mirós and the Picassos and the Matisses, et cetera. Indeed, we quickly—not effortlessly, but quickly—came to find out that our mutual major interest was abstraction, much more than realism. That interest pointed us in a certain direction, and post-World War II American artists became the center of what interested us, even aside from their relative affordability at the time. This was the late 1970s.

This was an era when Willem de Kooning was still working out in the Springs—in other words, it was a living time in the history of postwar American art. Did you fall into that Abstract Expressionist milieu in any way?

De Kooning’s gallery, Xavier Fourcade, was two blocks from here, in exactly the same position on 76th Street that we’re in now on 78th Street. We got to know him, and became friendly with him. He became more than a dealer—he became a friend and advisor about art. I actually had the pleasure of periodically visiting de Kooning’s studio in Springs along with Fourcade, who was really very committed to his artists. He went every two weeks to see de Kooning and to see what he’d been doing. He’d periodically pick out pictures that he’d like to take from the studio to his gallery, and he would call me—busily involved in trades at Goldman Sachs—and say, “Robert, I just got five new pictures, you have to come see them.” I would say, “Xavier, does 6-6:30 work for you? That’s the earliest I could possibly make it.” So I got there, we’d attack a couple of Scotches and view the new paintings, and we had a very wonderful time. In many ways, he really made it possible for me to become a collector. Because of his time and his patience.

Who else did he deal in, aside from de Kooning?

Let’s see—Georg Baselitz, Joan Mitchell, John Chamberlain. He had many artists, and he was involved with each of them. I think he was an extraordinary dealer. He had a rule for himself—I don’t know if it’s unique, but I never heard of it anywhere else—where, in every exhibition that he did, he bought a painting for himself. His rule was that he wouldn’t buy any picture from one of his exhibitions until a month or longer after the exhibition was over, because he wanted to give all the collectors a chance to buy the pictures if they wanted them. He told me, “Robert, I always had a favorite going in, and you know what? With very few exceptions, even at my most successful shows, I ended up getting the picture I wanted.” I said to him, “How did that happen? Did you cast some kind of a spell over people?” He said, “No, I think I liked the most advanced pictures—the pictures that were most different from that which had come before. Collectors found it much easier to buy that which they were more accustomed to, so the most difficult painting was likely to be left behind.” Isn’t that extraordinary?

You didn’t transition directly from Wall Street into the gallery business, I believe. What did you do immediately after retiring?

I was working with my wife, Adriana, to redevelop the Mayflower Inn in Washington, Connecticut, which was a property that had existed since the turn of the century. It was a run-down inn, with a charm and a history. Because Washington is a small town—meaning several thousand people—virtually everybody there had a relative who had taken part in building the some part of the Mayflower, from the stone walls to the inn itself. It was really a part of the community—the physical body of it, not the use of it, because it was for outsiders. For a long time it was a private inn, owned by a wonderful man. During his tenure Mrs. Roosevelt stayed there—he had big logbooks of the people who he had invited and who had stayed there. It turned over several times after he passed away in the early ‘40s before we found it. It was in disrepair and needed somebody to come along and fix it up.

It sounds like a real passion project.

Oh, it was a passion project. We didn’t realize when we bought it that we would have to tear it down and start over, but we started over and used the same footprints of the previous five buildings. We worked very hard to make them look old, just like the Mayflower was old. The people in the auction houses loved us—we were the only people who would buy Oriental carpets with holes in them. [Laughs]

But with the Mayflower we were very active patrons, if you will. We weren’t investors—we were much more than investors, we were actively involved. But we had managers. We had a dining room manager, we had a guest house manager, and all the professional people you need to run an inn, even it was very small, just 30 rooms. But it was on 50 some-odd acres, and amongst its amenities for guests was a beautiful landscaping job. Marvelous, marvelous landscaping.

How did your gallery originate?

It’s something that I had thought about, being very interested in art. What I really wanted to do was to curate shows. That’s what I really wanted to do. But who would hire me? I was 56 years old, and I have no degrees—it was unthinkable that any museum would hire me, and if they did they certainly wouldn’t hire me to do any major exhibition. And I wanted to do shows, so I started the gallery with the idea that we were going to do exhibitions. Of course we were going to be in the business of buying and selling art, but it would be built around an exhibition program. You were kind enough to mention three of our shows, and I’m very proud of our exhibition program over the last 23 years. They have essentially been not-for-sale exhibitions. We’ve always tried to have at least a few objects for sale, but in some instances only one, or even none, are for sale.

Because what I do when creating a show is identify a discrete selection of artworks that has the quality of a museum exhibition, with the only thing preventing it from being a museum exhibition being the scope or the size of the subject. If you were going to pick an important moment in an artist’s career, it could be terrific at 45 East 78th Street in these beautiful rooms, but you couldn’t fill a museum with, say, 24 Pollock drip paintings on paper. One of our most rewarding exhibitions was “Jackson Pollock: Drip Paintings on Paper,” which is a title that the catalogue raisonné gave them. Every one of those had been exhibited somewhere, but never had more than two been shown at any one time. When you saw 24 of them together, it was like a revelation.

I loved Eugene Thaw’s preface to the catalogue raisonné. I don’t remember it all, but I could paraphrase a little piece. He said, “now, fifty years later, it’s absolutely acceptable to call these works beautiful,” the inference being that if they’d been called beautiful when they were done, it might have made them seem less important than they were, not having then the power, the gravitas, they have now. Now it’s ok to call them beautiful, and indeed they are beautiful.

The space that you have here really does complement the artwork. I’m thinking especially of the Donald Judd “Stacks” show—the space just made them look fantastic.

You want to know something that I was amazed by? I didn’t plan the Donald Judd “Stacks” show because I knew there had never been one, but when I did the research I found that there had never been any show that had more than three stacks. No matter what museum it was, no matter where it was, there had never been more than three stacks. That’s an example of where we picked out a piece of an artist’s career to show because it was important for us, and because it was important to give the public the opportunity really study, think about, and look at it. We have fun here—we have school groups that come, things like that. That’s very satisfying for us.

What was the first show that you opened with?

I opened with de Kooning’s paintings from the ‘70s, which was a subject that I knew well. I’d already been collecting his work, and, as we talked about earlier, I already knew Xavier Fourcade the dealer well, and it was wonderful. Totally, totally abstract. I’ve done seven de Kooning shows, actually.

You had help in starting your gallery, opening it with the Los Angeles dealer James Corcoran and calling it C&M. How did the two of you come together?

C&M was born because I thought it would be very desirable to have a professional gallery person involved with me, so people wouldn’t say, “Who’s this guy from Wall Street with a few dollars who thinks he knows how to run a gallery?” So I asked my friend James, from whom I had bought my first de Kooning when he had a de Kooning show out there in the ‘70s. I had talked him over the years about owning a gallery, about me, my interests, my passions, and I said to him, “Jim, would you by any chance consider coming to New York and being my partner?” I thought there was no chance, because he loved surfing and playing golf and all that kind of stuff. But, he was also my friend, and it wouldn’t have been very nice to open a gallery and not ask him. I almost fell off the chair when he accepted! So Corcoran and Mnuchin, C&M Arts, was born.

You had been a collector for some time at that point. Did you have any experience in selling art?

No.

You had never sold any of your artworks?

Oh, I had sold a few works at auction to pay for something that I bought. But I never sold a work at auction to cash in the way you might trade a stock, which I knew something about. Never. I only sold to try to get the money to fund a new purchase.

On Wall Street you were a remarkably innovative trader—you created an entirely new form of trading called “block trading” that allowed buyers and sellers to traffic in enormous quantities of stock, laying the groundwork for the way the market operates today. What were some of the lessons that you were able to carry over from your Wall Street experience to the gallery setting?

It’s one thing to be patient if you believe that you’re right, it’s another thing to be stubborn about not being willing to sell something for less than you paid for it because you hadn’t made a good decision at the time. The single biggest difference between being a block trader and running the gallery was that on Wall Street we were simply providing liquidity for clients—we were not advising them on what to buy, we were not advising them on what to sell. Other parts of Goldman Sachs did that very well, but our division was about creating virtually instant liquidity for our clients once they decided to make a trade so that they could sell 300,000 shares of this or buy 80,000 shares of that without having to be in the marketplace and accumulate it over a period of time.

Prior to this institutions generally had what were called “one-decision stocks.” They made the single decision to buy it, and it took them a long time to buy it because there was very little volume in those days. It could take them a year to buy a position, a little bit each day. As you can imagine, people were a little more reluctant to sell them because they might have the same experience in reverse. Now we came along and said, “If you want to sell something, sell it, and we’ll get you a bid. We will get it done for you, as close to instantly as we can. If you want to buy something, same thing.”

An interesting question in the history of these sorts of things is to what extent did institutions start to manage their portfolios differently because they knew they had the liquidity to do it, and to what extent did block trading come along because institutions wanted to manage their portfolios differently, so an industry or a company came along to create the ability for them to do it? Which was the cart and which was the horse? We’ll never know.

How did you start cultivating collectors? Were a lot of them from Wall Street?

No. I don’t know how I started to cultivate them exactly, but interestingly I did little to no business with anybody that I knew from Wall Street, especially in the first five to 10 years. I think for the most part there weren’t many collectors in Wall Street. Certainly there wasn’t the kind of money there then as there is today. Absolutely not. Also, we, the average Wall Streeter, worked very, very hard, and there wasn’t really time to think about art or collecting. The other side of it is that if you care about something enough somehow or another you find the time, but something has to get you started caring enough about it, and there wasn’t much interest in art on Wall Street at that point.

How have you seen the market and tastes change since opening the gallery 23 years ago?

It’s just a vastly, vastly expanded industry in terms of numbers of people and in terms of from whence they come. There are collectors with art interests all over the world. You’re hard pressed to find a place on earth that’s not at least somewhat involved with collectors, art, or museums.

Has the definition of art changed in this period? It seems like it has become such a financialized commodity that a lot of people in these emerging markets are looking at is as an investment vehicle. Why else would everybody in the world be so obsessed with Western art?

I’m going to let you answer that question for us. The notion that art is an investment is irrefutable. On the other hand, I much prefer people who buy art for reasons of passion, not where the reason for buying is a form of investing. Either one is just fine, but in terms of the personal satisfaction of placing—and that’s the word that I use, we aren’t just selling—an object, is to place it with somebody who really cares about getting it and for whom that’s the major motivation in buying it. It’s a little idealistic, but that’s the way it is.

You deal with many of today’s greatest collectors, such as Mitchell P. Rales, whose private Maryland museum, Glenstone, is reputed to hold one of most magnificent collections of American art in the country. How would you describe the collectors that you work with?

Well, Mitch Rales was an interesting experience for me. I met him at the beginning stages of what became his growing, enormous, and most intelligent appetite for collecting and we just hit it off together. He very quickly developed a lot of confidence in me, and I very quickly developed a special feeling about who he was and what he was doing. He enabled or allowed us to be a team, which was unusual, not the way you think about things today.

For his opening show, if you read his catalogue, he was nice enough to say something in the introduction about the very large role I played in helping him collect the masterworks that were part of that first exhibition. It was an extraordinary privilege for me, and fun, and he became and is today remains one of my very best friends in the world. It’s not a client-based relationship—he’s much more interested in cutting-edge or at least later art, not so much of which I have, so our friendship today has nothing to do with me being a dealer.

It reminds me of when I was at Wall Street. I had a friend, Jimmy Murray, who was the same age as I was—we met when I was a trainee. Do you want to know what I made as a trainee at Goldman Sachs? Fifty dollars a week. It’s hard to believe, isn’t it? But Jimmy Murray became a young trader for Banker’s Trust Company in New York. He was like number three, and number three was close to sweeping the floors, which I was close to doing at Goldman Sachs as well. As we grew in importance and stature and came up the pyramid he became the head trader at Banker’s Trust and I became the head of what I was doing at Goldman Sachs.

We were really close friends, and we used to kid each other. He used to say to me, “Robert, one of us has to go into the button business.” “Why the button business?” “Well, it doesn’t really have to be the button business. But it would be good if one of us did something else, because there is that slight question of conflict of interest, where I’m a customer and you’re doing what you’re doing, and that puts this slight barrier up to our friendship and neither of us want any barriers.”

And then you went into the button business.

No, unfortunately he died young. I went into the button business too late to help.

What are some of the other kinds of collectors that you deal with? Is there a range? You obviously deal with the top collectors—do you prefer to deal with people who have institutions of their own, or who have institutions in mind when they buy?

No, not necessarily. There are some people who occasionally buy because they’re buying it as a promised or semi-promised gift to an institution, and that’s wonderful. But no, I’m certainly interested in people collecting, so to me a really successful purchase for someone is a work that they put on the wall or, if it’s a sculpture, on the floor, where every day, in some small way, the presence of that, the experience of living around that, is making their day better for them than if the work wasn’t there. That, to me, is a successful purchase.

Do you think there’s still room in the Postwar market? How does the gallery relate to the auction houses?

The auction houses do a terrific job on one hand, but they’re ferocious competition on the other. They make it more difficult for private dealers to get art because people are tempted to take it to auction, so they’re very serious competition. On the other hand they play a very important role in terms of setting the prices and doing things to create the confidence of a marketplace.

You once bought a $75 million dollar Rothko at an auction, so you have a rare position within that market.

Well, that was for a client—it wasn’t for me.

What would you say are some of the most valuable pieces that have passed through your hands?

That’s hard to say. I wouldn’t know where to start, because some of the most valuable pieces today were a totally different price at the time. On the other hand, if it was top quality, it was always priced differently than other works by the same artist, because top quality has always had a premium. Put differently, it’s always been a little painful to buy the best, at least in the short term. There’s a work right now that auction houses are competing for where the price is going to be somewhere between 30 and 40 times the price the collector paid. My point is that when you say “the most expensive things,” when they passed through my hands at $3 million or $2 million or $5 million, it was a lot of money. It was really a lot money. By today’s standards, particularly in art, it’s still a lot of money, but what it represents in purchasing power has changed.

It seems to me that you've been taking a little bit of a new direction in your last couple of shows. You did the El Anatsui show, now you’re doing the Kazuo Shiraga show, and next month is Simon Hantaï. All three of these represent very different historical trajectories.

There’s a little bit of coincidence there, in that those three shows were things that we had on our mind, they fell into place, and they happened to fall into place consecutively. But it doesn’t mark a new beginning, where this is just the first 50 percent of what we’re going to do. Not so.

What are some areas in art history that you’re excited about delving into in the future, beyond the Hantaï show.

Well, we’re working on a show for fall, our first fall show. I’m not sure if the title will stick with what it is right now, but basically it’s a form of Minimalism. It’s “Carl Andre and His Friends.” His friends include all the major Minimalists: Judd, Agnes Martin, Ryman, Flavin, et cetera. The core—the floor, if you will—will be multiple works by Andre, and there’s likely to be one outstanding example of some of these other people, hence the title “Carl Andre and His Friends.” Now, that’s not at all contemporary. That’s going back to history. It will be beautiful.

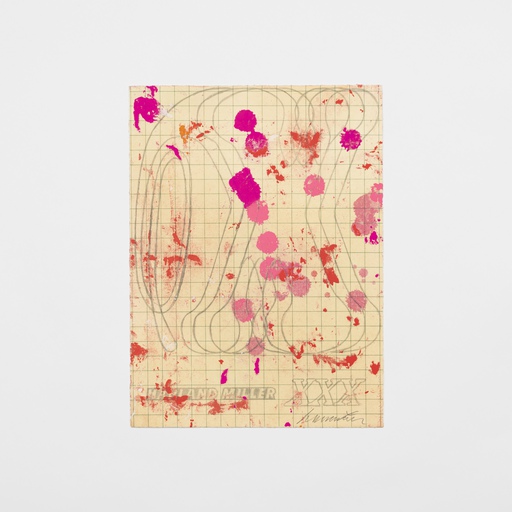

The show you currently have up, of the Gutai member Kazuo Shiraga, is an exceptional fusion of art history and contemporary relevance. The paintings stem from the ’50s and ‘60s, yet the show is being hailed by critics as one of the most radical paintings exhibitions anywhere. His market, too, has skyrocketed in recent months. Why did you decide to show Shiraga?

Shiraga was clearly his own man, and to compare him to anybody else would be a disservice to him. Nevertheless, I instantly saw a rigor and an activity and an action and a passion in him that I hadn’t seen or experienced since the ‘70s de Koonings. Much like them, pictures that in many cases were now 50 years old felt like they were painted yesterday. The paint seems like it’s still wet. If you go back and look at some of the Shiragas in the exhibition you’re almost afraid to touch them because you’re afraid the paint will come off your hands. It’s absolutely extraordinary.

When you mount a show, especially of an artist with whom you’re a little bit less familiar—and I couldn’t possibly be as familiar with Shriaga as I am with de Kooning or Rothko or people I’ve been looking at for decades—the works never stay constant, in my experience. To say they disappoint would be too strong, but they either flatten out a little bit, or, when you’re really lucky, you get a little bit more excited every day. My experience with Shiraga has been that I am a little bit more excited every day. I can’t wait to open the front door to 45 East 78th Street to be met by beautiful Shiragas all around.

To the extent that he’s gotten so much attention so quickly—maybe even a little too much—I don’t think it really matters overall, because I think this work really has legs and will remain outstanding for a long time to come. I think the work itself is just marvelous, and I don’t want anybody to be distracted by the fact that he hung from a rope and painted it with his feet. That’s fascinating, but what is ultimately important is what’s on the canvas.