BY THE NUMBERS

The season of art market performance reports is upon us, and keeping up with them all can be an all-consuming—and sometimes baffling—affair. In the last month various entities have declared 2013 to have been both the best year ever and the second best year ever for art sales, while also (erroneously) declaring art to be that year’s worst performing alternative asset class, ranking behind wine, stamps, cars, and other collectibles in profitability. Of course, part of the problem is that each firm defines its markets differently—sometimes looking at just the auction sector, sometimes trying to compare year over year sales figures for individual artists. But casual readers—and journalists in the financial press who know little of the art market, but nonetheless breathlessly tout the numbers—should consider a host of hidden conflicts and biases that render most of these statistics next to meaningless.

Perhaps the most reliable broad-based report comes from the European Fine Art Foundation—organizers of the TEFAF fair that opened this week in Maastricht—which pegged last years art and antiques market at about $66 billion, just shy of the all time record of $67 billion achieved in 2007, right before the crash. These figures conform with the widely held view that even if parts of the world continue to limp, the art market, like the American stock market, is once again at the top of its game. Looking at more granular data, the numbers are less convincing. The Foundation estimates turnover in China at $16 billion, a two percent growth in value. Yet the China Association of Auctioneers last month claimed fine art sales in 2013 of $5 billion, reflecting growth of more than 22 percent. The implication of the two figures is that the private sales market in China is contracting—or someone’s numbers are wrong.

One of the stranger recent findings—the claim that art investments lost three percent of their value between mid 2012 and mid 2013—came from the 2014 Wealth Report issued by real estate consultants Knight Frank. This hard-to-fathom claim is perhaps indicative of the naïve number-crunching undertaken by investment advisors who know little of the peculiarities of the art market.

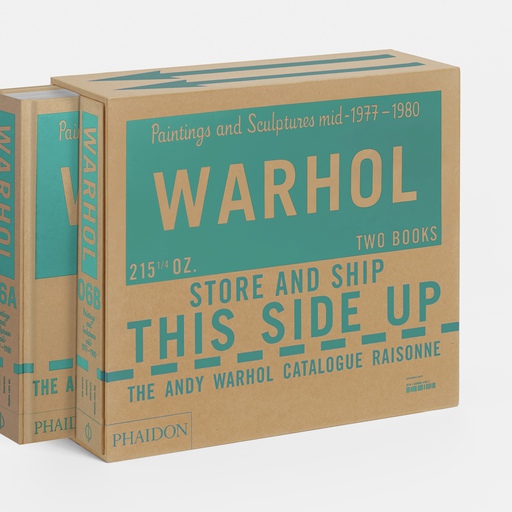

The most important factor overlooked by data analysts is the lack of comparibility between art objects (except multiples, such as prints, issued directly by the artist—and even here caveats apply). That's why old-fashioned connoisseurship remains a byword in art circles. It takes years of study to understand why one painting by an artist is bounding up in value while others languish. This is not to say that those new to art should hesitate to spend on what they love, or even to invest. But the place it begin to understand the micro-markets that make up the larger $66 billion behemoth is individual prices for individual works.

The art market is notoriously opaque and, at one time, the only way to know those figures was to attend auctions and make notes in your catalogue. Happily, art journalists now catalogue primary and secondary sales around the world in art-fair writeups. Dozens of such articles came out of New York last week. Check them out and write down the figures for any artist who interests you. In the meantime, forget about big-picture reports—it's the individual paintings that matter.

IN THE NEWS

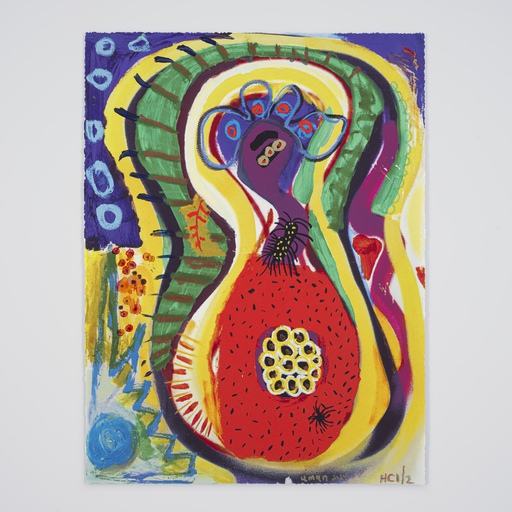

— Islamic artists, especially those of the Gulf region, take center stage at two very different venues this month. In Houston, the 15th FotoFest biennial, running for six weeks beginning this weekend, showcases video, photographic, and multimedia art by nearly 50 artists, including Youssef Nabil and Huda Lutfi (from Egypt), Hassan Hajjaj and Lalla Essaydi

(Morocco), Ebtisam AbdulAziz and Lamya Gargash (UAE), and Abdulnassar Gharem (Saudi Arabia). The survey, with several exhibitions coordinated by lead curator Karin Adrian von Roques under the umbrella title “View From Inside,” aims to provide Western audiences with access to underexposed regional talents, who grapple with themes ranging from displacement and colonialism to technology’s imp ace on identity.

On the other side of the globe, Art Dubai, the Gulf's premier art fair, opens on March 19. While only about 15 of the 70 galleries hail from the region, the international galleries make a point of highlighting local artists as well as those of the Islamic diaspora who now live in Australia, North and South America, and Europe—creating one of the best environments to take in the breadth of art in this explosively creative category. For the first time, the fair has created a modern section, with a dozen galleries presenting the work of 15 20th-century artists. Among the names to look out for at exhibitions in the coming years are the finalists included in Abraaj Prize exhibition: Abbas Akhavan, Kamrooz Aram, Bouchra Khalili, Basim Magdy, and Anup Mathew Thomas.

— Two recent announcements have threatened the balance of art world calendars for 2015. Art Basel in Hong Kong will move it from May to March next year. The move will make it easier for blue-chip galleries to show at both the prime Asian event and Frieze New York, but force them to choose between Hong Kong and the ADAA and Armory fairs. Frieze New York, however, will be competing for jet-setting collectors with the Venice Biennale’s opening week, which will take place a month earlier than usual thanks to Italian tourism officials who want it to coincide with a food-themed world expo in Milan.

The Venice bacchanal attracts a specific kind of patron, and Frieze can probably weather the loss of a few whales for one year. On the other hand, both Hong Kong and the Armory have faced complaints in recent years from exhibitors concerned about reaching the right kind of visitors—those who buy. (Though this year's Armory Show tallied exceptionally strong sales, according to reports.) Assuming more date changes aren’t in the offing, this may be a chance for both to fine turn their approaches to serve local/regional markets rather than compete for the lucrative but narrow slice of international boldface-name collectors.

AWARDS AND KUDOS

— Next month, Gagosian artist Richard Phillips makes his museum debut at Dallas Contemporary, where “Negation of the Universe,” a survey of a sculptures, videos, and hyperrealistic paintings, will highlight the artist’s relentless dissection of American pop culture.

— Brooklyn-based photographer Daniel Gordon, who participated in the Museum of Modern Art’s 2009 “New Photography” show, has won the Photography Museum Amsterdam’s Foam Paul Huf Award for his works that blend collage, sculpture, and photography while updating traditional art-historical genres.

— At a gala this week MIT bestowed its Eugene McDermott Award in the Arts—accompanied by a residency and $100,000—on Icelandic-German artist Ólafur Elíasson.

— Three sound installations by Keren Cytter, Cally Spooner, and Hannah Weinberger will round out the program of specially commissioned works debuting at this year’s Frieze New York art fair, running May 9-12 on Randall’s Island.

COMINGS AND GOINGS

— No so many years ago, Hauser & Wirth operated with the sort of understatement and discretion one expects from the Swiss. More recently the backers seem to have set their global ambitions on competing not merely with top galleries but with museums, at least in terms of square footage. This summer the art purveyors will unveil new work by Phyllida Barlow spread across an entire campus—including restaurant, restored farm buildings, and new gallery spaces—in Bruton, Somerset, about two hours west of London. During a recent visit to New York the firm’s Los Angeles partner Paul Schimmel explained that they had yet to announce a West Coast location because they are looking for a space large enough to handle multiple concurrent museum-worthy exhibitions.

— For years artists San Francisco’s tech-driven real-estate boom has led artists to relocate across the Bay, and now the affects are being felt at one of the city’s tonier gallery addresses. Just down the block from Union Square, the tenants at 77 Geary Street, including such stalwarts as George Krevsky Gallery and the Rena Bransten Gallery, are being evicted to make room for an Internet services company that reportedly offered to pay double their rent.

— Acquisition is taking on a new meaning in the museum world. On the heals of the announcement that the National Gallery would be taking control of the collection and exhibition program of D.C.’s Corcoran Museum, word has leaked that the MoCA North Miami board is ready to hand its holdings over to Miami Beach’s Bass Museum. Talks between the two museums were revealed by the mayor of North Miami, who sought to scuttle the nearly done deal, while MoCA allies responded that the move was forced by the rejection by North Miami residents of a $15 million bond measure in 2012 that would have allowed the museum to expand.

WE HEAR

— Gavin Brown’s enterprise, which has managed one of the most notable and sustained balancing acts mixing blue-chip roster with an anti-market fringe attitude, is said to be on the search for a new space. Part of the gallery’s allure stems from Brown’s decision to locate on the periphery of the art world—in the 1990s it has operated out of a single-story space tucked behind Brown’s own bar on 15th street, and for the last decade in a off-the-art-path neighborhood west of SoHo and south of the Village. It will be interesting to see where he heads next.