While Lehman Brothers hurtled towards financial ruin, the value of its corporate art collection remained sound—if it wasn't increased by the hype around the economic calamity. The works, after 2008, were suddenly souvenirs from the downfall. A 2010 auction raked in over $12 million, with works by John Baldessari, Glenn Ligon, and Julie Mehretu, and in a 2009 auction a 1982 Roy Lichtenstein went for $49,000, more than twice its high estimate. Although the banking house ultimately failed, clearly its art curators knew how to turn a profit. (Indeed, the proceeds from the art went to the bank’s numerous creditors.)

Beyond populating the walls, the works amassed by a small team led by Michael Danoff were smart financial investments, and mostly by early and mid-career artists. The then early-twenty-something Alex Glauber was a part of this global art team, acting as an assistant curator.

Since the fall of the behemoth bank, and the divestiture of the collection, Glauber has gone on to advise clients, corporations, museums, and individuals on emerging and mid-career artists through his company AWG Art Advisory. He’s also put on shows like an outdoor painting exhibitions “Battle of the Brush” in Bryant Park in 2011 and, last month, a show about color told through its material history at Simon Dickinson.

We spoke with the young advisor about collecting art for corporate giants, and the purpose of art in the office.

RELATED LINK:

Painting With Mummies? Art Advisor Alex Glauber on the Unexpected History of Color

Walk me though how you went from graduating a Northeastern liberal arts college to your job at Lehman Brothers, where you worked to amass an art collection in the offices across the globe.

I found the Lehman Brothers job by this totally serendipitous fluke. After doing that prototypical post-college unpaid internship where you are over-qualified and resentful of the menial tasks you’re doing, in 2006 I went on Monster.com and I typed in “curator.” It was such a random thing to do, but what came up was a listing for Lehman Brothers, which was looking for a curator for their art program—though the department, of course, had no idea that human resources had put up a generic ad on a site like Monster.com. All of the qualifications far exceeded my own, so I wrote a really candid letter saying that, you know, "I realize I am grotesquely under-qualified for this position, but what you do sounds fascinating," and asked if I could meet with them. And actually I did have some qualifications, including having been asked by the director of the Portland Museum of Art in Maine to be an assistant curator on the mid-career retrospective of John Bisbee, a local sculptor. So I met with the director and was hired as an intern and then an assistant curator, and two months later, was on a plane to Dubai, recommending acquisitions and helping curate the collection for these offices all over the world.

Was there an existing collection that you were working with?

Lehman Brothers inherited an approximately 600-piece collection from this company they bought in the early 2000s called Neuberger Berman. The founder, Roy Neuberger, was a major collector of emerging American artists throughout his career. He was one of the first people to collect Pollock and all that. Roy actually went to Paris in the ’20s and wanted to be a painter, but like so many collectors realized that he could never make it as an artist. But he still wanted to be around art, so he started Neuberger Berman with the express purpose of making enough money to buy art. Starting in 1990s, the firm started to acquire emerging and mid-career artists. If you start collecting emerging artists in 1990, a number of those artists will become very much established today.

That seems like a smart strategy for building a strong corporate art collection, to invest in emerging artists.

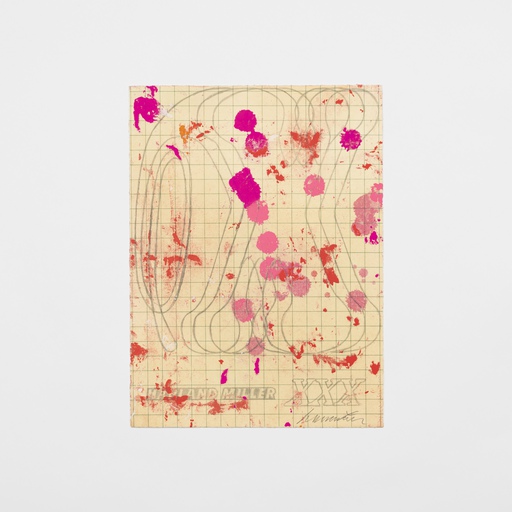

Every company puts something on their walls. Whether they call it a collection or not depends on how they approach it conceptually. Because the truth is that for the amount of money that companies spend on decorative prints—often cringeworthy pieces somewhere above hospital art but often on par with ersatz Thomas Kinkade posters—you can buy interesting emerging artists. Whereas Neuberger was collecting emerging artists and contemporary work at the time, Lehman was acquiring prints from many of those artists years later, after they’d become fully established. So an example would be that Neuberger had a great early Mary Heilmann painting that they probably got for less than $10,000 in the ’90s. If you were to go buy something comparable in 2005, it would have cost you $120,000 at least. So instead, Lehman had been acquiring Mary Heilmann prints.

So Lehman Brothers switched gears to collecting up-and-coming artists from around the globe?

In 2006, Lehman was aggressively trying to build out their global presence. In hindsight, it was part of the over-leveraged strategy that led to their demise, but the whole idea was to compete or to at least be alongside Goldman, JP Morgan, Morgan Stanley, in these emerging markets in Dubai, Seoul, all over. Art was part of that footprint.

How did you incorporate this Western art collection into these global offices?

So, let’s say we were doing an office in Mumbai. We’d take pieces from the Neuberger collection and lend them to the office—even though it was one company—and then we’d acquire artworks for the Lehman collection locally. So we had a mixture of some well-known artists in the Western canon and then also go over there and meet with a number of local galleries and do studio visits and buy some local works. The idea was that each of the offices spoke to the local community and culture but then also represented the more globally expansive nature of Lehman.

Then Lehman Brothers went bankrupt in 2008, becoming patient zero in the global economic crisis. What happened to the collection then?

Basically the court appointed trustees to run the estate and be in charge of unwinding everything. From an art standpoint, it had this funny and unfortunate parity—it was like being a kid and going to a playdate at your friend’s house and your mom and your friend’s mom have tea while you play and then your mom tells you it’s time to put all the blocks away because you're going home. So for two years, it was like we were taking all these blocks and building this nice fort, and then we had to put them all back.

Was that disheartening?

It was, but it also was just such a logistical nightmare too, and we were in just sort of a fog. And I think also, you know, I was young, I was 24, 25. I knew it was a big deal, but it was not as though I had tons of stock in the company and was making a lot of money. So I mean it was all just sort of crazy.

What do you mean?

I was fortunate enough to be retained by the estate, and they kept paying me to help. We just sat in this odd holding pattern for a while, but, you know, the job was to figure out how this stuff was going to be sold. It was a nightmare, because, well, you think of Lehman as one company, but each of these regional branches are their own entities. So when Lehman Asia got sold to Nomura and then Lehman America got sold to Barclay’s, we had some art that was bought with the intention of going to the New York office but was sent to Hong Kong. Then all a sudden the New York Barclay’s gets their asset ledger with everything they’ve bought with Lehmann and they see this work of art and ask, “Well, where is that?” We were like, “It’s in Hong Kong….” And now technically that is owned by Nomura.

That sounds very complicated.

To make matters even more complicated, Neuberger Berman persisted. They were held out of the bankruptcy. Technically, it meant that when Lehman went bankrupt, all the art in the office that had been Neuberger art, if Neuberger Berman wanted to keep it, they had to buy it for a second time, because it was Lehman owned. So not only did they have to buy it for a second time, but what that means is that that Glenn Ligon you bought for $2,000, in 1991, if you wanted to keep it, even though it had never left the wall, you had to buy it for a second time and buy it at fair market value, so you’d buy it at like $300,000. So it was just lunacy.

How long did you stay through all of that?

I stayed for a year and then went out on my own. It was a really depressing environment. There's an inherent conflict of interest in bankruptcy proceedings, because the better you do your job, the more quickly you lose it. So while I was doing that, initially, when I left Lehman and Neuberger, I realize what limited amount of experience I had had was in the corporate realm. It occurred to me that every company puts something on their walls, and most don’t realize that you can put together an interesting “collection” for not very much money. So I started this company with a really unfortunate name called Corporate Art Solutions. The name really says it all. This was in 2009.

How did that company operate?

The premise was that I had enough friends who worked at private equity funds and hedge funds from Lehman and from just being a prep school kid from the Northeast. So I started talking to companies that wanted to spend some money putting things on their walls and I started curating what you can call these temporary exhibitions, but what they really were temporary corporate collections, where I was working directly with artists and specific galleries in curating these temporary exhibitions that were made available on a lease-to-buy model.

The idea was that they were thematically curated so that the company could serve those two audiences, the internal and the external. The idea lends itself to decorating. So I was trying to do something with substance.

What function do you think art ideally serves in the workplace environment?

It serves a very abstracted function—you can’t measure it. But it seems to me that taste and value—not financial value—are such subjective exercises that it's all about how you position and contextualize the art. No need to tell people that the work is there to do more than just decorate your walls, and you can do that by presenting it in a formal manner, with wall labels and a curitorial text. It serves a number of purposes. First, it reaches your internal staff—and given how much time these people spend in their offices, they actually end up taking great pride in the art that is there. They become really possessive of it in a way. But then it also reaches an external audience, and is a great way to represent a corporate identity and humanize it, for lack of a better word. If you have an investment company and you need high-net-worth individuals to come in, well, if they're art collectors, then that's a great way to get them to come in and meet with the company.

How does art in the office impact a worker’s ethic and productivity?

I’ve done a fair amount of work with these architectural firms and we’ve done research into these things, and it is hard to really measure. As soon as you get someone to acknowledge that in a verbal manner, it becomes somewhat contrived: “Totally, it makes me more proud to work and work harder.” But it actually is subversive, in a positive way, in the degree to which it can promote creativity and diversity in thinking.